Retailer cooperatives have long helped smaller, independent stores purchase in volume. These loose confederations could also be an answer for ecommerce shipping and returns.

The idea is simple: A group of retail businesses pool their money to buy in bulk.

Cooperatives have helped small retailers boost buying power. Could the concept work for ecommerce shipping?

A hardware store in Boise, Idaho, wanting to stock DeWalt tools might not have enough buying power to get the best prices. But if it cooperated with 50 independent hardware shops nationwide, suddenly the group would have the collective resources to be taken seriously.

That’s a retailer cooperative in action.

Shipping at Scale

Turn your attention to shipping and returns. There are at least three ways that scale — the size of a business — can impact ecommerce shipping.

Fulfillment centers

Walmart, the retail giant, earned about 17% of its revenue from ecommerce in 2023. The company had 34 ecommerce fulfillment centers and 100 ecommerce distribution facilities in the United States at the beginning of 2023.

These facilities expedite delivery by placing items close to customers — a dual advantage over an SMB retailer shipping from a single location. Walmart can deliver an identical item more quickly since it has less distance to travel, and the shipping cost should be lower for the same reason.

Physical locations

Physical locations allow shoppers to pick up orders and drop off returns. Walmart can aggregate those items and reduce reverse shipping costs.

Carriers

The third advantage is an in-house delivery operation. Consider Amazon Logistics. In 2023, it carried 5.9 billion parcels, according to a Pitney Bowes report. UPS hauled some 4.6 billion parcels, and FedEx carried 3.9 billion. Only the United States Postal Service delivered more domestic parcels than Amazon Logistics.

Without its logistics division, Amazon would have to pay and rely on USPS, UPS, or FedEx. And Amazon is not the only ecommerce business with some form of delivery.

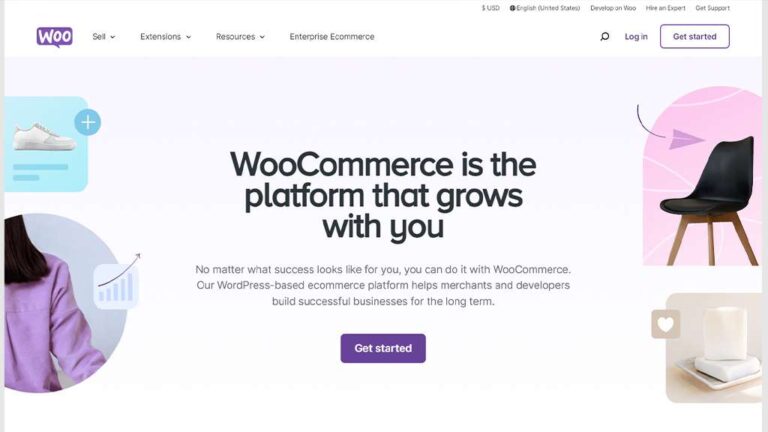

Cooperation

I know few, if any, ecommerce SMBs that have considered a cooperative to compete on shipping. Perhaps this article will get them thinking.

Store locations

Retailers can ship for each other. Imagine you own a hardware store in Boise, Idaho. You belong to a retailer cooperative with another shop in Michigan. You both stock and sell the DeWalt DW46RN roofing nailer. Both stores have the nailer listed on their websites.

The Michigan shop receives an order for the DW46RN from a customer in Nampa, Idaho. A ground shipment via UPS would take at least four days. Your Boise shop could deliver the nailer in one day — and for much less money.

Effectively, a retailer cooperative of 50 shops would resemble 50 strategically located ecommerce fulfillment centers.

The concept could extend to dropping off returns, too. If the same customer needed to return the nailer, he could drop it off in Boise, saving shipping costs.

Carrier options

Cooperating stores could take advantage of alternative carriers. According to the Pitney Bowes report, “other” carriers grew 28.5 percent in 2023, handling more than 600 million parcels collectively. Many of these “others” are regional package carriers and ride-share services that can deliver quickly.

The roofing nailer could arrive at its buyer in an hour if the Michigan shop and its Boise partner worked together, likely involving joint systems.

Worth Exploring

Retailer cooperatives (different from retail, no “er,” cooperatives, which are groups of consumers) give independent stores or chains more collective buying power.

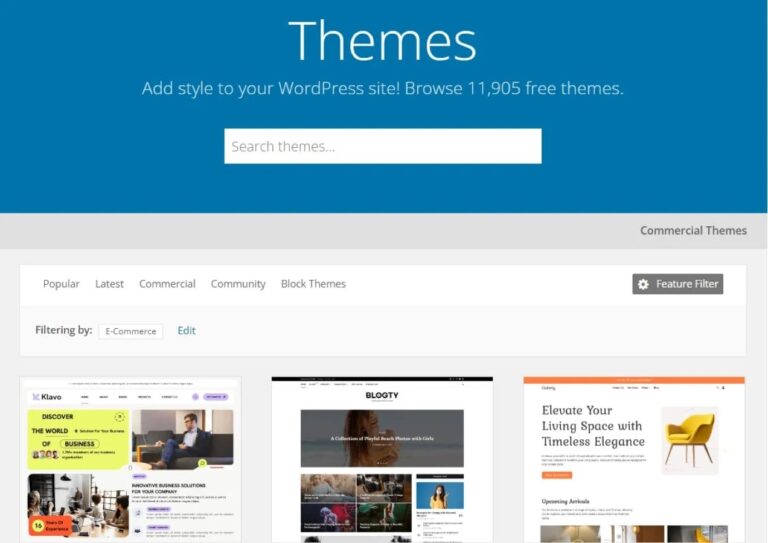

Could retailer cooperatives apply to other parts of a business, such as ecommerce fulfillment? It’s worth exploring, particularly by those competing with enterprise brands.