Google is revving up its product search results, making it easier for consumers to price shop without leaving search engine page results.

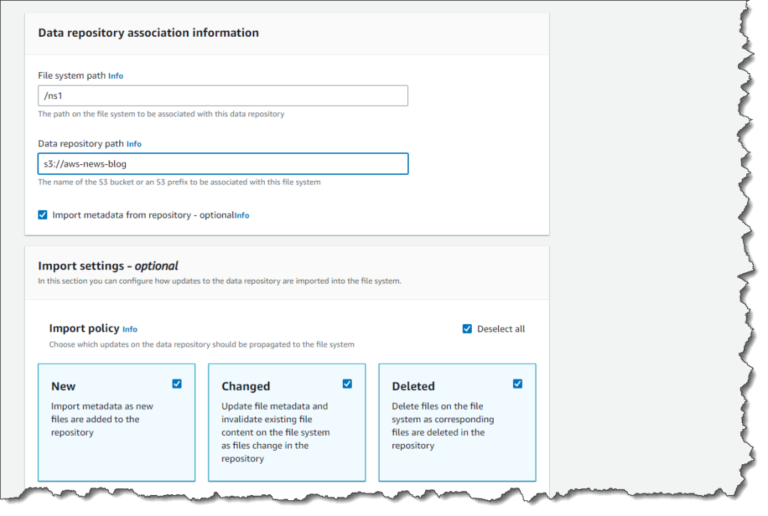

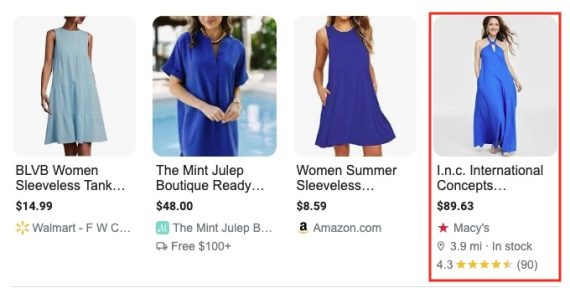

Search for an unbranded product such as “buy blue womens sun dress” and scroll past sponsored listings and local results. Below that, on the primary SERP, Google added a grid of tile-like product boxes triggered by purchase-intent queries. Each tile can include a product name, images, price, store name, average star ratings, and review count.

Product boxes appear on primary SERPs and can include product names, images, prices, store names, average star ratings, and review counts. Click image to enlarge.

The tiles function differently from conventional organic results. Instead of sending shoppers to a product detail page on an ecommerce site, the tiles link to shopping knowledge panels that load in the SERP. The panels are similar to product detail pages but with one big difference: Google tacks on a merchant list with pricing.

“This is particularly useful for users because they can compare prices much more easily,” says ecommerce SEO consultant Aleyda Solis. But for online stores, it’s yet another hurdle to get the click.

How Google ranks product tiles remains unclear. But they are populated by structure data — Schema.org markup or similar. SEO consultants and ecommerce store owners have wrestled for years over which structured data types are worth publishing since Google wasn’t paying attention to all of them.

But last February, Google expanded support for product structured data, announcing new shipping and returns classes and product variants such as sizes, colors, and materials. This will likely bury skirmishes about the value of structured data since visibility in product grids and shopping knowledge panels depends on it.

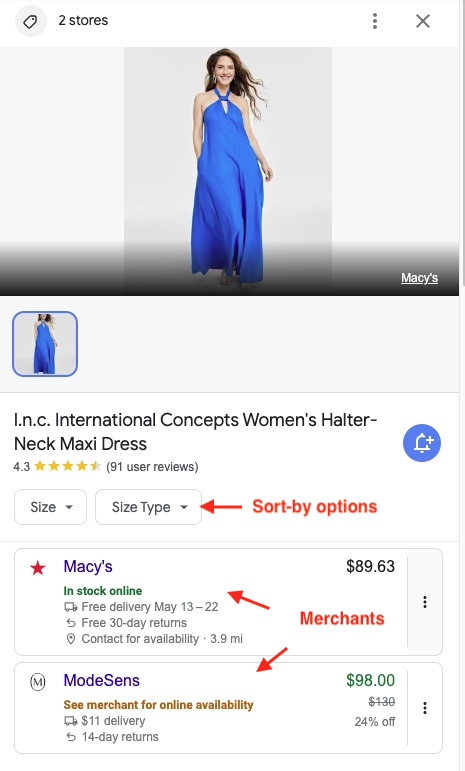

Shopping Knowledge Panels

In shopping knowledge panels, the store name on the product tile gets the top ranking on the merchant list. But size, color, and other sort-by options let shoppers reshuffle the merchant list by those variants.

Shopping knowledge panels load directly in SERPs and contain sort-by options that reorder the list of merchants. Click image to enlarge.

The sort-by feature will likely incent store owners to get their Schema act together or risk disappearing from the merchant list. Shoppers using the feature could unwittingly filter out merchants that ignore product variants.

“If you have technical constraints or don’t have a developer, there are tools that facilitate the implementation of product Schema markup. Wordlift is one. Schema App is another,” says Solis. You can also use ChatGPT to generate product Schema.

For ecommerce merchants, the shopping knowledge panel lessens the importance of unique landing pages. Many searchers will likely go straight from the product grid to the shopping knowledge panel to a merchant’s product detail page.

The development could be a win for Amazon, which will appear in more product knowledge panels due to the breadth and depth of its catalog. Moreover, Amazon could use predatory pricing to undercut smaller ecommerce stores in merchant lists.

Last September, Google’s domain name registrar business was acquired by Squarespace. “Maybe Google thinks we won’t need domains anymore,” speculates Ross Kernez, a digital strategist. “If everything gets converted to SGE [Search Generative Experience] and only ecommerce survives, the top of the funnel will be gone. Transactional queries will still be here, but that means people could need fewer domains,” says Kernez.

Mike King, CEO of marketing agency iPullRank, disagrees. “We’ve heard of the death of websites when mobile apps appeared. People were like, we’re not going to need websites anymore. Everything’s going to be an app. Well, that didn’t happen,” says King.

Diminished Value?

Either way, conventional organic listings are getting pushed further below the fold. With AI results, paid shopping, pay-per-click ads, map packs, forums, image carousels, and now product grids, it is possible to secure top traditional organic rankings and receive less traffic.

With the rise of ChatGPT, the growth of product review search on TikTok and Instagram, and the recent completion of its March core update, Google appears to be reinventing web search and, perhaps, diminishing the value of organic search as a marketing channel.

The result could force marketers to prioritize other traffic sources such as social networks, email marketing, and generative AI optimization.

Google’s enormous audience cannot be ignored. But with so much volatility in the SERPs, diversifying ecommerce traffic sources is becoming increasingly important. I see no evidence of ecommerce merchants shifting resources from organic search to TikTok, ChatGPT, Reddit, and Facebook. But it does appear that relying on organic traffic is getting riskier.