Are you a business owner struggling to manage your finances? Do you want to tap into a more efficient and convenient way of making payments? Well, you’re in luck! We’ve rounded up the top 10 NFC payment mobile apps that will help you take control of your finances and boost your ROI. Not only do these apps make payments easier and faster, but they also add a touch of modern convenience and security that will keep your business running smoothly. So don’t wait any longer and join us as we precisely explore the world of contactless payments.

1) Understanding NFC payments

In today’s fast-paced digital world, it’s important for business owners to stay ahead of the game when it comes to managing finances. That’s where NFC payments come in. NFC, or Near Field Communication, is a technology that allows two devices to communicate with each other by simply touching or bringing them close together. This technology has revolutionized the way businesses handle payments, making transactions faster, more secure, and incredibly convenient.

But how exactly do NFC payments work? Well, it’s quite simple. When you make a purchase using an NFC payment app, your smartphone or other NFC-enabled device communicates wirelessly with the payment terminal. All you need to do is tap your device on the terminal, and voila! The payment is made. It’s as easy as that.

One of the key advantages of NFC payments is their speed. Gone are the days of fumbling for cash or waiting for credit card payments to process. With NFC, transactions are completed in a matter of seconds, saving you precious time and keeping your business running smoothly.

Not only are NFC payments quick, but they’re also highly secure. These apps use encryption and tokenization to protect your payment information, making it virtually impossible for hackers to access your sensitive data. This gives both you and your customers peace of mind knowing that their financial information is safe and sound.

Another major benefit of NFC payments is the convenience they offer. You no longer have to carry around a bulky wallet or worry about misplacing your credit cards. With just your smartphone, you have everything you need to make purchases. This means fewer items to keep track of and less stress in your daily business operations.

By understanding the ins and outs of NFC payments, you can see why this technology is rapidly gaining popularity among businesses. Its speed, security, and convenience make it a game-changer in the world of finance management. So, why wait? Embrace the power of NFC payments and watch your business soar to new heights.

2) Benefits of using NFC payment apps

In the fast-paced world of business, every second counts. And when it comes to managing your finances, efficiency is key. That’s where NFC payment apps come in. These innovative mobile applications precisely offer a wide range of benefits that can help take your business to the next level.

- Speed and convenience: NFC payment apps allow for quick and seamless transactions. With just a simple tap, you can make payments in a matter of seconds, saving you and your customers valuable time. No more fumbling for cash or waiting for credit card transactions to process. NFC payments are fast, efficient, and incredibly convenient.

- Enhanced security: The security of your financial transactions is of utmost importance. NFC payment apps provide an added layer of security through encryption and tokenization. This means that your payment information is protected, making it virtually impossible for hackers to access your sensitive data. Your customers will also appreciate the peace of mind knowing that their financial information is safe and secure.

- Reduced costs: Using NFC payment apps can help you save on costs associated with traditional payment methods. By eliminating the need for physical credit cards or cash, you can streamline your operations and reduce the risk of theft or loss. Additionally, NFC payments often come with lower transaction fees, allowing you to maximize your ROI.

- Improved customer experience: In today’s competitive business landscape, providing a seamless and convenient customer experience is essential. NFC payment apps offer just that. By embracing this technology, you can enhance your customers’ experience, making it easier and more enjoyable for them to make purchases. This can lead to increased customer loyalty and repeat business.

- Integration with loyalty programs: Many NFC payment apps offer integration with loyalty programs, allowing you to reward your customers for their continued support. By offering incentives such as discounts or exclusive offers, you can encourage repeat business and build stronger customer relationships.

- Real-time analytics: NFC payment apps often come with built-in analytics tools that provide valuable insights into your business operations. From sales data to customer preferences, these analytics can help you make informed decisions and optimize your business strategies.

- Stay ahead of the curve: Adopting NFC payment apps demonstrates that your business is forward-thinking and embracing new technologies. This can help you stand out from your competitors and attract tech-savvy customers who value convenience and innovation.

3) Importance of choosing the right NFC payment app for your business

Choosing the right NFC payment app for your business is crucial for maximizing efficiency and ensuring a seamless customer experience. With so many options available, it can be overwhelming to decide which app is the best fit for your specific needs. That’s why we’re here to help you navigate through the process and highlight the importance of making the right choice.

- Tailored Features: Different NFC payment apps offer various features and functionalities. It’s essential to choose an app that aligns with your business requirements. For example, if you have a retail store, you may need an app that allows for inventory management and integrates with your point-of-sale system. If you operate an online business, you might prioritize apps that provide secure online payments and seamless integration with your website. By selecting an app with tailored features, you can streamline your business operations and enhance the overall efficiency of your payment processes.

- Compatibility: It’s important to consider the compatibility of an NFC payment app with your existing devices and infrastructure. Ensure that the app is compatible with the operating system of your smartphones or tablets. Additionally, check if it integrates smoothly with your point-of-sale terminals or e-commerce platforms. Compatibility issues can cause disruptions in your payment workflow and lead to unnecessary frustrations for both you and your customers.

- Security Measures: Security should be a top priority when selecting an NFC payment app. Look for apps that offer robust security features such as data encryption, tokenization, and two-factor authentication. These measures protect sensitive customer information and minimize the risk of data breaches. Remember, a breach in security can have severe consequences for your business reputation and customer trust.

- Customer Support: When implementing any new technology, it’s crucial to have reliable customer support. Look for NFC payment apps that provide comprehensive customer support, including phone, email, or live chat assistance. This ensures that you have access to prompt help whenever you encounter issues or have questions about the app’s functionality. Prompt and effective customer support can save you time, money, and stress in the long run.

- Pricing Structure: Consider the pricing structure of NFC payment apps before making a decision. Some apps charge a flat monthly fee, while others have transaction-based fees. Evaluate your business’s payment volume and calculate the cost-effectiveness of each app. It’s important to find a balance between the app’s pricing and the value it provides to your business.

By taking into account these factors, you can make an informed decision when choosing the right NFC payment app for your business.

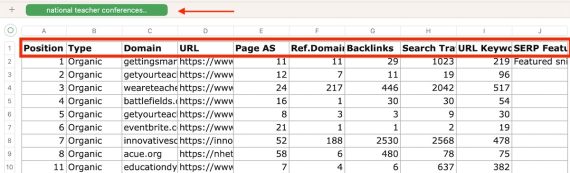

4) Criteria for selecting the best NFC payment apps

By considering following criteria, you can select the best NFC payment app for your business, ensuring a seamless and secure payment experience for both you and your customers.

- User-Friendly Interface: One of the most important criteria for selecting an NFC payment app is its user-friendly interface. The app should be intuitive and easy to navigate, allowing both you and your customers to make transactions effortlessly. Look for apps that offer a clean and simple design, with clear instructions and options.

- Integration with Existing Systems: Another important factor to consider is the app’s compatibility and integration capabilities. The app should seamlessly integrate with your existing point-of-sale system, website, and other business tools. This ensures a smooth payment process and prevents any disruptions or technical issues.

- Security Features: Security is paramount when it comes to handling financial transactions. Look for NFC payment apps that prioritize security measures, such as data encryption, tokenization, and two-factor authentication. These features help protect your sensitive data and ensure the safety of your customers’ information.

- Customer Support: When using any new technology, it’s essential to have reliable customer support. Choose an NFC payment app that provides prompt and efficient customer support, whether through phone, email, or live chat. This ensures that you have access to assistance whenever you encounter any issues or have questions.

- Pricing Structure: Consider the pricing structure of NFC payment apps before making a decision. Look for apps that offer transparent and reasonable pricing plans, with no hidden fees or charges. Evaluate the cost-effectiveness of each app based on your business’s payment volume and needs.

- Reviews and Recommendations: Take the time to read reviews and seek recommendations from other business owners who have experience with NFC payment apps. Their insights and experiences can help you make an informed decision and avoid potential pitfalls. Look for apps with positive reviews and a solid reputation in the industry.

Top 10 NFC payment mobile apps for businesses

Are you ready to revolutionize your business payments? Look no further! We have carefully curated a list of the top 10 NFC payment mobile apps that will take your financial management to the next level. These apps precisely offer seamless, secure, and convenient payment solutions that will not only save you time but also boost your ROI.

- Cash App: Simplify your transactions with Cash App. It allows you to send and receive money instantly with just a tap, making it perfect for businesses on the go.

- PayPal: Trusted by millions, PayPal is a versatile payment app that allows you to pay, get paid, and manage your money all in one place. With its secure NFC payment feature, you can make quick and hassle-free transactions.

- Venmo: Venmo has become a go-to app for peer-to-peer payments, and it also offers NFC capabilities. It’s perfect for small businesses and freelancers who need a convenient way to send and receive payments.

- Google Pay: With Google Pay, you can simply tap your device at any NFC-enabled payment terminal and complete your transactions effortlessly. Plus, it integrates seamlessly with other Google services, making it a convenient choice for Android users.

- Apple Pay: If you’re an Apple aficionado, Apple Pay is the perfect choice for you. It allows you to make secure NFC payments with your iPhone or Apple Watch, providing a seamless and effortless payment experience.

- Samsung Pay: Samsung Pay takes NFC payments to the next level by also offering magnetic stripe and contactless payment options. This means you can use it with virtually any payment terminal, making it incredibly versatile for business owners.

- Square: Square offers a comprehensive payment solution for businesses of all sizes. With its NFC-enabled card reader and mobile app, you can accept payments easily and manage your finances seamlessly.

- Zelle: Zelle is a peer-to-peer payment app that allows you to send and receive money instantly. Its NFC capabilities make it a great choice for businesses looking for a secure and efficient way to transfer funds.

- Stripe: Stripe is a powerful payment platform that offers NFC capabilities through its mobile app. It’s ideal for businesses looking for a reliable and customizable payment solution.

- Shopify Pay: If you have an online store, Shopify Pay is a must-have. It offers NFC payment capabilities along with a host of other features that make managing your online business a breeze.

6) Case studies on businesses that have successfully integrated NFC payment apps

In the fast-paced world of business, success stories inspire and motivate us. And when it comes to NFC payment apps, there are plenty of success stories to share. These case studies demonstrate how businesses have successfully integrated NFC payment apps into their workflows, transforming their financial management and boosting their bottom line.

Case Study 1: Mary’s Coffee Shop

Mary, the owner of a small coffee shop, wanted to enhance her customer experience and streamline her payment process. She decided to integrate an NFC payment app into her business. By offering customers the option to make contactless payments, Mary saw a significant increase in sales and customer satisfaction. The ease and convenience of NFC payments kept the lines moving precisely and reduced wait times. As a result, customers were more likely to return and recommend Mary’s coffee shop to others. Mary’s business flourished, and she was able to focus on what she loved most – making delicious coffee.

Case Study 2: Mike’s Food Truck

Mike, the owner of a popular food truck, was tired of dealing with cash and the risk of theft. He decided to implement an NFC payment app to simplify his transactions and improve security. With the new app, customers could precisely tap their phones to pay, eliminating the need for cash or cards. The ease and security of NFC payments attracted more customers to Mike’s food truck, as they appreciated the convenience and peace of mind. As a result, Mike’s sales skyrocketed, and he was able to expand his business by adding new menu items and hiring additional staff.

Case Study 3: Sarah’s Boutique

Sarah, the owner of a trendy boutique, wanted to create a seamless and modern shopping experience for her customers. She integrated an NFC payment app into her store, allowing customers to make contactless payments with their smartphones or smartwatches. The convenience of NFC payments made the checkout process quick and easy, which resulted in higher customer satisfaction and increased sales. Sarah also used the app’s analytics tools to precisely gain insights into customer preferences, allowing her to tailor her inventory to meet the demands of her target audience. As a result, Sarah’s boutique became a go-to destination for fashion-forward shoppers, and her business flourished.

These case studies illustrate the power of NFC payment apps in transforming business operations. By embracing this technology, businesses of all sizes and industries can improve efficiency, enhance customer experience, and drive growth.

Tips for integrating NFC payment apps into your business workflow

Ready to take your business to the next level with NFC payment apps? Here are some tips to help you seamlessly integrate these apps into your business workflow.

- Plan Ahead: Before implementing NFC payment apps, take the time to plan out your strategy. Determine how these apps will fit into your existing payment processes and identify any potential roadblocks or challenges. This will help you streamline the integration process and ensure a smooth transition.

- Educate Your Staff: Make sure your employees are well-versed in the benefits and functionality of NFC payment apps. Provide training sessions to ensure they understand how to use the apps and can confidently assist customers in making contactless payments. This will not only improve efficiency but also enhance the overall customer experience.

- Promote Contactless Payments: Encourage your customers to embrace NFC payment apps by promoting their benefits. Display signs and stickers at your checkout counter to let customers know that contactless payments are available. Offer incentives such as discounts or exclusive offers for customers who choose to make contactless payments. This will help drive adoption and increase customer loyalty.

- Test & Monitor: Once you’ve integrated NFC payment apps into your business workflow, continuously test and monitor their performance. Look for any areas of improvement or potential issues and address them promptly. Stay updated with software updates and new features offered by the app developers to ensure you’re getting the most out of the technology.

- Collect Customer Feedback: Don’t forget to gather feedback from your customers regarding their experience with NFC payment apps. Use this feedback to identify areas for improvement and make necessary adjustments. This will show your customers that you value their opinions and are committed to providing the best possible payment experience.

8) Common pitfalls to avoid when using NFC payment apps

As with any technology, there are a few common pitfalls to avoid when using NFC payment apps. It’s important to be aware of these pitfalls to ensure a seamless and hassle-free payment experience. Here are some key things to keep in mind:

- Lack of User Education: One of the biggest pitfalls is a lack of user education. Many customers may not be familiar with NFC payments or how to use them. It’s important to educate your customers on how to make payments using NFC and provide any necessary guidance or instructions. This will help prevent any confusion or frustration at the point of sale.

- Connectivity Issues: NFC payments rely on a stable internet connection. If you’re in an area with poor connectivity, you may experience issues with processing payments. It’s important to ensure that you have a reliable internet connection to avoid any disruptions in your payment workflow. Consider having a backup plan, such as a mobile hotspot or alternative payment method, in case of connectivity issues.

- Compatibility with Older Devices: NFC payments require devices with NFC capabilities. If you or your customers are using older devices that do not have NFC, you may encounter compatibility issues. Make sure to check the compatibility of your devices before implementing NFC payments to ensure a smooth and seamless experience for everyone involved.

- Inadequate Security Measures: While NFC payments offer enhanced security, it’s important to choose an app that has robust security measures in place. Look for apps that offer encryption, tokenization, and two-factor authentication to protect sensitive customer information. Additionally, make sure to stay updated with any security patches or updates released by the app developer to mitigate any potential security risks.

- Lack of Customer Support: It’s important to choose an NFC payment app that provides reliable customer support. In the event that you encounter any issues or have questions about the app’s functionality, having access to prompt and effective customer support can make a world of difference. Make sure to choose an app that offers comprehensive customer support options, such as phone, email, or live chat assistance.

By being aware of these common pitfalls and taking the necessary precautions, you can ensure a smooth and secure payment experience for both you and your customers. Don’t let these pitfalls hinder your ability to tap into the benefits of NFC payments and watch your business thrive.

9) Future trends and developments in NFC payment technology

As we continue to embrace the power of NFC payment apps, it’s important to look ahead and explore the exciting future trends and developments in this technology. The world of contactless payments is evolving rapidly and precisely, and there are some fascinating advancements on the horizon that will shape the way businesses manage their finances.

One of the key future trends in NFC payment technology is the integration of biometric authentication. Imagine making a payment simply by scanning your fingerprint or using facial recognition. This technology not only adds an extra layer of security but also offers a more convenient and seamless payment experience. With biometric authentication, businesses can ensure that only authorized individuals can make transactions, further protecting sensitive financial information.

Another exciting development is the expansion of NFC payments to other devices beyond smartphones. We’re already seeing the integration of NFC technology in smartwatches, fitness trackers, and even connected cars. This opens up a world of possibilities for businesses, allowing for contactless payments in a variety of settings and making transactions even more accessible for customers.

In addition to expanding the range of devices, NFC payments are also becoming more integrated with other emerging technologies. For example, we’re specifically seeing the convergence of NFC and Internet of Things (IoT), enabling seamless payments in smart homes, retail stores, and other IoT-enabled environments. This integration allows businesses to create personalized and tailored payment experiences for their customers, enhancing customer satisfaction and loyalty.

Furthermore, as the adoption of NFC payment apps continues to grow, we can precisely expect to see more innovative features and functionalities. This includes enhanced analytics capabilities, allowing businesses to gain valuable insights into customer behavior, preferences, and spending patterns. These insights can be used to optimize marketing strategies, improve product offerings, and drive business growth.

As we look to the future, it’s clear that NFC payment technology is poised to revolutionize the way businesses handle their finances. With advancements in biometric authentication, device integration, IoT connectivity, and analytics, the possibilities are endless. By embracing these future trends and developments, businesses can stay ahead of the curve and provide their customers with seamless and convenient payment experiences. So, get ready to tap into the exciting future of NFC payments and watch your business thrive in this new era of digital finance.

Conclusion

In conclusion, the world of NFC payment mobile apps is full of potential and possibilities. By embracing these innovative technologies, businesses can streamline their payment processes, enhance customer experiences, and ultimately boost their bottom line. The top 10 NFC payment mobile apps that we’ve explored offer a range of features and functionalities that can cater to different business needs and preferences. From the speed and convenience of Cash App to the versatility of PayPal and the seamless integration of Google Pay, these apps are designed to make your life easier and your business more efficient.

But it doesn’t stop there. As we look to the future, the advancements in NFC payment technology hold even more promise. With the integration of biometric authentication, expanded device compatibility, and the convergence with IoT, the possibilities are endless. Businesses that tap into these future trends and developments will be able to stay ahead of the curve and provide their customers with truly seamless and convenient payment experiences.

So, what are you waiting for? Take control of your finances, boost your ROI, and join the contactless payment revolution today. Whether you’re a small business owner, a freelancer, or a retail giant, there’s an NFC payment mobile app out there that’s perfect for you. So go ahead, explore the world of NFC payments, and watch your business soar to new heights. And if you’re looking to hire top mobile app developers in India, don’t forget to reach out and discover the endless possibilities that await you. Happy tapping!

In case you have found a mistake in the text, please send a message to the author by selecting the mistake and pressing Ctrl-Enter.