Which is easier for an online store looking to grow — finding more customers or getting each one to spend more in every transaction? The second choice is better — increasing average order value.

Why? Because to get more customers, you have to spend money on marketing efforts. To increase the average order value, you don’t necessarily need to do any marketing, you just do a more effective job of selling what you already have.

There are proven strategies you can implement to increase your store’s average order value, and that’s what we’re going to look at today.

What is average order value?

Average order value (AOV) is just what it sounds like — the average dollar amount a customer spends per order. The more money each customer spends, the higher your average order value will be.

Companies that sell higher-priced products will have a higher average order value. That doesn’t necessarily mean they have more revenue overall though. You might sell $2000 pieces of furniture, but if you only sell ten per year, you’re making a lot less money than a business selling products for five dollars, but selling millions of them.

So average order value is distinct from revenue and profits. It’s a way to measure what each customer spends on each order and is related to lifetime customer value (LTV), because if you also know how many orders the typical customer places in their lifetime, you can use AOV to calculate LTV.

And knowing your average lifetime value helps you determine how much is reasonable to spend on marketing to reach new customers.

How to calculate average order value

This part is fairly simple. To calculate average order value, just take your total revenue over a period of time, such as a year, and divide it by the number of orders placed. Here’s the math:

Average order value = Total revenue/number of transactions

Average order value is one of your most important metrics because it helps inform business decisions like your marketing and product pricing strategies. Your business health depends on knowing your revenue potential, and part of that comes from knowing what your customers spend.

Considerations with calculating AOV

It might be smart to do your average order value calculations using different measures of time. That way, you can see trends. For example, suppose you calculate AOV based on the revenue and orders for a year, and you get an average dollar amount of $150.

But then, you might calculate AOV for each month of the same year of purchase history, and discover it was steadily increasing from January through June, then took a nosedive in the summer and fall, and then skyrocketed up to $225 in December.

This would suggest some important insights. The first half of the year, your efforts to increase the average transaction value seemed to be working. But changes in consumer routines in summer and fall seem to have disrupted your efforts. Then, holiday shopping led to a huge increase in average transaction size.

This is just hypothetical. The point is that you’ll find a lot more detail in the month-to-month data than if you only looked at an AOV calculation for the entire year.

Mean and median

Another factor to consider when doing AOV calculations is the type of average you’re calculating. The formula above is for what is known in mathematics as the mean. In general, the mean is what you want to use when calculating average order value.

But in some situations, you might want to use the median. The median is the halfway point. That is — half your values are above it, and half are below it. Microsoft Excel can easily compute either type of average, as can other software programs.

The median makes more sense in situations where a few extreme outliers might skew the average value.

Let’s say you sell a range of products priced between $20 and $300. But, you also sell a big ticket item for $3500, like a personal coaching or consulting service. Most of your buyers will purchase your normal products. But whenever someone buys the coaching service, it will drive up the mean order value and cause it to be a little less accurate. Using the median will eliminate the effect of extreme outliers.

You could also compute two means. Do one that excludes higher priced items, and do another that includes them. The first would give you a sense of a typical customer’s average transaction value. The second would give the actual average amount and reflect your revenue more accurately.

Benefits of increasing average order value

Online retailers devote a lot of attention to attracting new leads and customers. But successful ecommerce businesses also depends on profit margins, not just customers. The amount your customers spend matters, and here are four ways it helps your business.

Higher revenue

This one is pretty simple. When you make more money per order, you make more money. Higher revenue is always better than lower revenue, and if you can realize revenue growth with fewer customers, that’s even better because it doesn’t require as much effort and spend from marketing.

Higher profits

Better than higher revenue is higher profits. With less money required to be spent on marketing to earn the same or higher revenue, your gross profit margins will be higher, too.

Why is this true? In addition to marketing, consider costs such as packaging, shipping, and inventory. With larger orders, these other costs don’t go up as much as they do when you have smaller orders, but more of them.

A larger box doesn’t cost twice as much as two smaller boxes. And oftentimes, depending on your products, there’s wasted space in shipping containers. So for customers who order more items, packaging and shipping expenses barely rise — you just make more profit.

Faster profitability and ROI

Most ecommerce businesses start off in the red, meaning they invested money to get the business going, and want to get a good return on their investment. The sooner the better, because then you can expand, grow, and increase revenue and profits.

With higher average order values, you’ll reach profitability sooner because your net profits per order are higher.

Higher customer lifetime value

Winning a customer is harder than keeping a customer. Both are important, but with higher average order values, you’ll make more money from each customer over their lifetime.

This means you can run a more robust marketing program with confidence that the long-term returns will be worth a higher investment. If each customer brings in more revenue throughout their relationship with your company, you can justify a higher customer acquisition cost in the first place.

Higher customer lifetime value gives a business more stability.

Ways to increase average order value

So, you know the benefits of increasing your average order value and you know how to calculate it. Now, let’s figure out how to do it.

You can start implementing several of the following strategies all at the same time, and most of them don’t take very much time or investment to make happen. Many of these methods work so well because they influence consumer behavior such that everyone feels like a winner.

Offer an upsize

Depending on what you sell, this might be the best strategy for increasing average order value. And you can see how well it works with simple examples. Does the large drink really cost that much more for the restaurant than the medium drink? Of course not — the larger size increases their profits.

Just about any product can be upsized as long as you have the packaging. Plus, customer behavior shows that people like choices. So even if they don’t buy the bigger one, it can make the smaller size even more appealing. And if someone is buying a variety of items, the lower-priced smaller one allows them to justify spending more on other items. Thus, the larger size — even if unpurchased — can still result in a larger order value.

An upsize is one type of an upsell, a proven strategy for increasing average transaction size.

Offer an upsell or two

For online stores, this can be done relatively seamlessly. Once a customer orders something, you can present an upsell page offering them a great deal that will increase their order value. Before reaching your checkout page, they have to decide to either take that deal or say “no thanks.”

Online funnel guru Russell Brunson calls these a one-time-only offer — an OTO.

Suppose you’re ordering a bag of dog food for $29.99. But if you take advantage of this one-time-only offer, you can get two bags for $49.99. For products that get purchased repeatedly, volume discounts like this are a great deal for the customer because they’re going to use it anyway. And for you, it increases your order value.

You can offer all sorts of things as upsells. Offer complementary items. Offer a gift card. Offer a membership. Find things that will appeal to the person who is buying a particular item. Or, offer these things to anyone who buys anything from your store, and make it a standard part of checkout.

Is upselling the same as cross-selling?

For some people, these are very different. They’ll tell you that upselling refers to a larger or more expensive version of the same product, or buying more than one as in the example above.

And cross-selling refers to selling items related in some way to the original purchase. A gift card would technically be a cross-sell, under this definition.

And while these terms aren’t the same, in many ways it is a distinction without a difference.

Why? Because the purpose you’re offering these is the same — to increase AOV. Whether you’re offering a bigger or better version of the same product, or a related product that’s desirable to the customer, you’re offering both after they have decided to buy, using similar strategies and with similar technology.

So what’s better? Upselling or cross-selling? The answer is — whichever one works for your business. Or both.

Use urgency

This is one of the easiest and most time-tested strategies for influencing customer behavior. Urgency achieves several positive outcomes. But one of them can be higher average order sizes.

The OTO is an example of urgency. To get this deal, you have to decide now, or it goes away. It’s not available anywhere else, and you’re offering it to thank them for buying from your online store.

You can also use time-deadlines, inventory scarcity, and holidays to justify urgency.

Increase your prices

Changing your pricing strategy is about the simplest way to increase your average order size. Just raise your prices. Suppose you’re selling 1000 widgets per month at $12.99. Raise it one dollar to $13.99, and you just increased your total revenue from that product by $1000. And almost all of that new revenue will be profit, because you didn’t change anything else.

Will you lose customers if you raise your prices? There’s a mathematical component to this. How much can you raise your prices to offset the loss of customers?

Look at the streaming industry. They’re hashing around various marketing and pricing strategies, ad-supported and ad-free services, and other approaches. When they raise their prices, some customers unsubscribe. But how does that affect their revenue?

Suppose a streaming company charges $7 per month and has 125 million customers. That’s $875 million in monthly revenue. Now, if they raise their prices to $8 per month, and 10 million people cancel their memberships, what happens? Well, with 115 million subscribers at the higher price, they’re making $920 million per month. So even though they lost customers, their revenue is higher. At that volume, one dollar still goes a long way.

That’s a great real-world pricing strategy example that lots of people are talking about.

Your ecommerce business can do the same thing. Even on a much smaller scale, the principle is the same.

There’s a point at which you can justify a higher price, even if it costs you some customers, because your revenue still increases.

Create product bundles

Bundling is a terrific strategy for increasing average order value because you’re creating a package of items that doesn’t have a clearly comparable price anywhere else.

With product bundles, the idea is to combine multiple products into a new, all-in-one collection sold together as a set. So, the Backyard BBQ collection, the Summer Getaway collection, the Holiday Grab Bag — these are the sorts of names you see for product bundles.

Few people will go and look up your prices for the eight items in your bundle. They’ll just appreciate the simple convenience of ordering the collection of complementary products.

You sell more items. You ship them all at once. The customer pays more money than they otherwise would have and is happy with the great deal and good service represented in the bundle.

Online and ecommerce businesses wanting to create product bundles to increase their average transaction size can use the Product Bundles extension from WooCommerce.

Offer perks for spending above a minimum purchase threshold

This is one of the best strategies for increasing average order value, and it will also increase your conversion rates, as will many strategies in this article.

The idea is, get people to spend more by rewarding them if they spend more. Like bundling, this works well because everyone feels like they’re getting a great deal. And they are.

Here’s the process for making this work. First, look at your sales data and calculate your current average order value. Then, choose a number 15-20% above that. Last, decide what reward to offer to customers who spend over that average amount.

For example, if your average customer spends $50 per order, offer a desirable bonus or reward for anyone who spends over $60. Examples of perks you can offer include:

- Free gifts

- Entries into a contest

- Entry into a customer loyalty program or VIP program

- Free shipping

- Flat dollar discounts — not percentages

An example of how that last item works is, “Spend $60 or more and get $5 off.”

If your average order size is $50, then getting them to spend over $60 will result in a big revenue bump. But wait, you might be thinking, if they spend $60, aren’t we just discounting the extra amount they just spent?

In most cases, no. People won’t spend exactly $60. They will spend more than that. You do the flat dollar discount because no matter how much more than $60 they spend, the discount is the same. If you offer a 20% discount, the amount you refund them goes up no matter how much they spend.

Free shipping

Shipping costs aren’t getting any lower. That’s why more online businesses are starting to set a free shipping threshold for customers who don’t want to feel like they’re paying extra for shipping.

As mentioned, consider the current average value your customers are paying for their orders, and decide at what point you’re willing to enact a free shipping threshold and eat the costs to win their business. It might be $50, $100, $75, or some other amount.

And there may be more factors influencing this decision than just average order value. For instance, how large are your products? What is their typical weight? How much of the shipping costs have you already baked into your pricing strategy?

You don’t want to get caught paying tons of money in shipping costs just to appease potential new customers with unrealistic expectations. But, to win higher value business, offering free shipping with a set threshold is an idea to consider. Once customers spend more than that, they’ll feel liberated to spend even more, so your average order may just continue to increase.

Offer memberships

We mentioned this earlier as part of an upsell, and memberships can be perfect for that. But you can also just sell memberships — promote them right on your Checkout page. Promote them all over your site. Every product page can also pitch the membership and the value customers will enjoy by joining.

Memberships increase customer lifetime value and customer retention in addition to raising the average order value at the moment they sign up.

And once they’re members, you can begin selling more often through the membership, at discounted prices and with whatever benefits come with the membership. This is probably the most complicated strategy listed in this article, but if you can make it work, you reap the rewards of recurring revenue, in addition to bumping the average order value and strengthening your customer base.

Back to the free shipping question, you can also make free shipping a benefit of membership. Then, only your existing customers get free shipping, and you’re partially covering the costs through the membership.

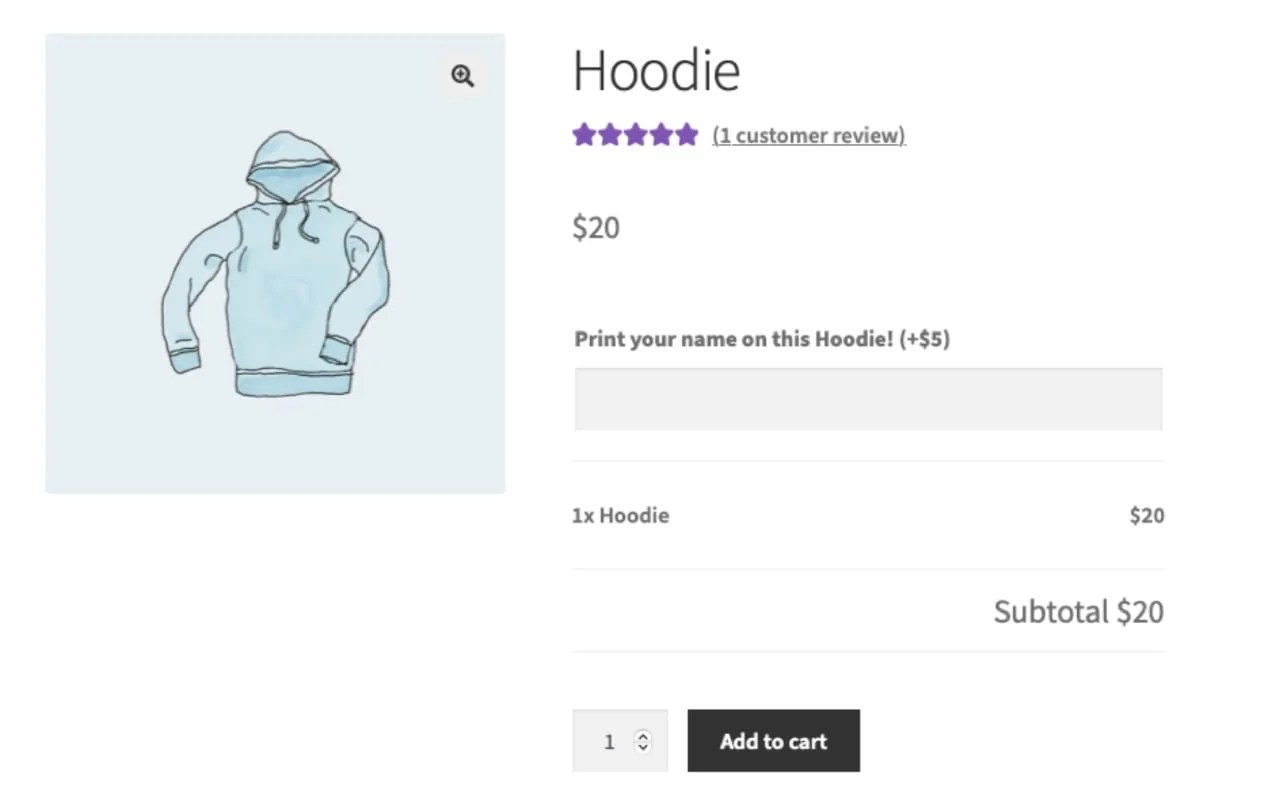

Offer add-ons

Product add-ons are little additions to a product the customer is already buying that make that product just a bit better. For example, an air pump that comes with an extra set of needles and a convenient case to store them.

The idea is, the add-on should only increase their online order by a small amount. This is not a bundle, because a bundle is a pre-set package of complementary products that might share a commonality or two, but that aren’t directly related.

An add-on is just a small addition that makes something they’re already buying a bit more appealing. It could also be something like gift wrapping.

You can easily make add-ons part of your ecommerce store using the Product Add-Ons extension.

Feature social proof on key pages

This may not seem like a strategy to increase AOV, but think about your higher-priced products. These encounter a bit more resistance from a typical buyer. These are also the ones that increase your average order size.

With effective social proof like product reviews, testimonials, and screenshots, you can reassure hesitant shoppers that this product really is worth buying and that the price shouldn’t stop them.

Most people don’t buy based on price alone. Good social proof will push some of them to say yes and spend more.

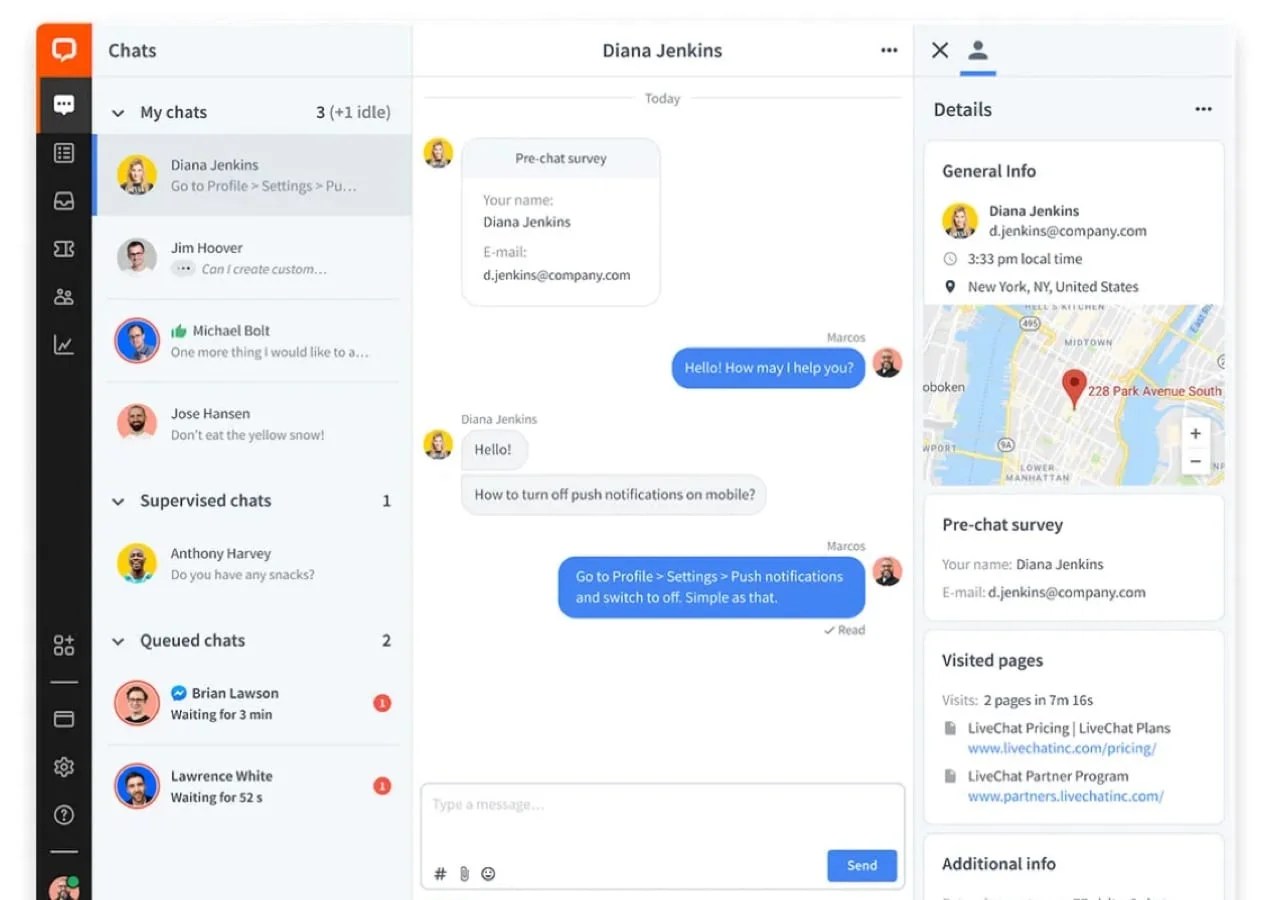

Use live chat customer support

Like social proof, sometimes customers are hesitant to buy because they have questions, uncertainties, or other confusions holding them back that could be resolved if they could just talk to someone. But talking to someone is hard, especially online since so many ecommerce businesses don’t have staff for full phone support.

But live chat is a bit less costly from a labor perspective, and it’s a more direct way to engage with customers who are in the midst of shopping and have a quick question or two they need answered.

By offering live chat support, you can address some of these questions in the moment, and remove obstacles that are preventing them from buying. So live chat can increase your conversion rates, but it can also increase your average order value, because the customer might be considering buying four items, but they have questions about two of them.

Without live chat, they’ll buy the two they were already planning to get, but might leave the other two there because they have questions and don’t want to hassle with help forums. With live chat, if you can address those questions, they might end up buying three or all four products.

In this way, live chat isn’t just good customer service to support long-term brand loyalty, It’s part of your marketing efforts.

Allow customers to include personalized cards

A personalized greeting card adds a lot of value when someone is sending a gift to another person. For friends and relatives who live far away, a note with the gift will make the whole experience of giving and receiving it much more meaningful for everyone. It’s an intangible value unrelated to the product itself.

And adding a service like this to your products costs you very little once you have the system set up for it. Charging $5 or some other low price bumps up your order value while serving a need some of your customers will have. And they won’t mind paying for a small increase in cost that carries with it great emotional and relational value.

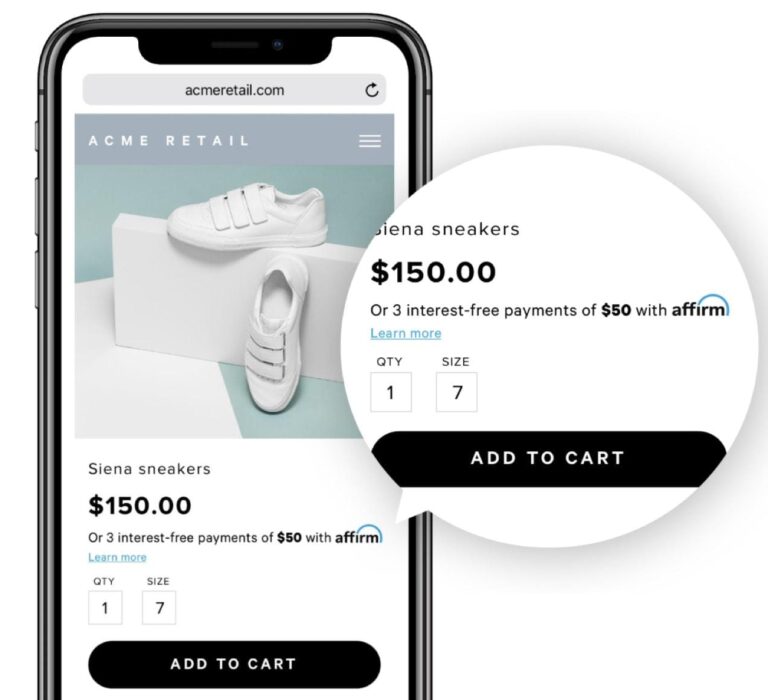

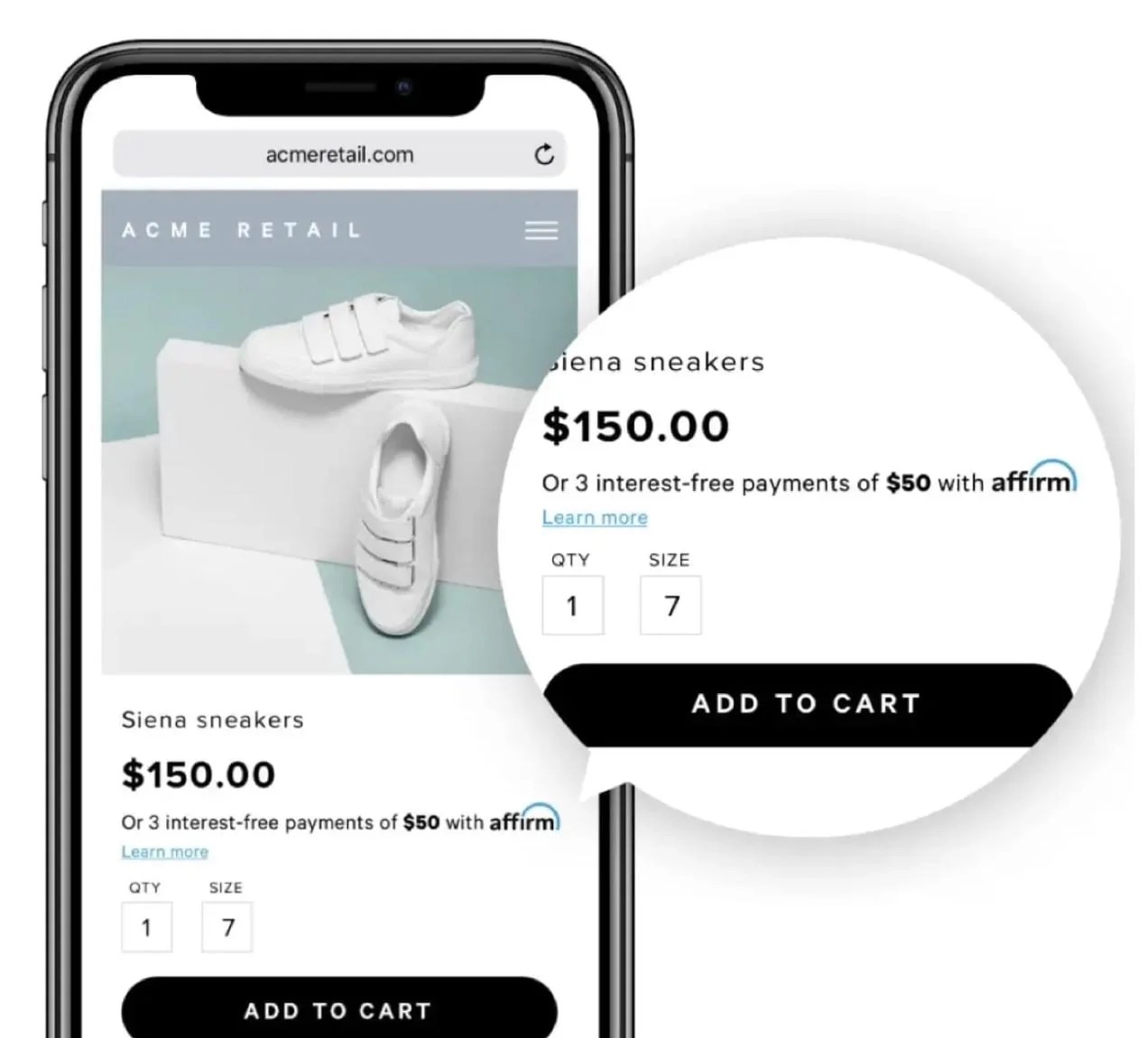

Offer a payment plan

Sometimes, the issue holding people back from buying higher-priced items is… the price. They want the product, but can’t afford it right now.

If you can offer customers like this a payment plan option, they may take you up on it. With this system in place, you’ll close more sales for your higher-priced products.

And to be clear, “higher-priced” can even mean something around $100. Buy now, pay later services (BNPL) were created to allow customers to buy higher-priced products and not have to pay for them all at once. Typically, customers can break payments into four installments. And the services offering BNPL typically cover the full cost of the item up front. So you get paid the full amount at the point of purchase, and the customer then pays back the BNPL provider in four payments.

There are several buy now, pay later services that can be activated for WooCommerce websites, such as Affirm, Klarna, PayPal, and Sezzle. Each has various pros and cons.

Raise your average order value

Take a look back at the marketing and pricing strategies you just read, and pick the ones you want to start using first. You can have some of these set up by the end of the day. Others require a bit more time.

But all of them allow you to increase AOV and give your online business the overall revenue stability and profitability you’re seeking so you can continue to not just sell online, but thrive online.