Determining the true costs of credit card processing can be complicated. Business owners customarily divide total fees by the number of transactions to arrive at an effective rate. Over time, however, as payment service providers introduced alternative fee structures, pricing models, and payment methods, statements became confusing, both for merchants and competing providers trying to win their business.

AI-powered tools can analyze merchant statements more efficiently than humans and deliver competitive proposals in minutes instead of days. Practical Ecommerce discussed with payment pros the opportunities and challenges of using artificial intelligence to evaluate transaction histories, pricing, and data.

AI-powered tools such as Fee Navigator help merchants know the total cost of credit card processing.

Messy Statements

Caroline Hometh, managing partner at RPY Innovations, a payments consulting firm, helps clients navigate the inconsistencies in merchant fee structures and nomenclature.

“Our industry is notorious for using opaque and inconsistent language when describing fee structures, which I think is done intentionally,” she said. “This is partly because the whole system is so complicated that it is near impossible to describe every element of each transaction accurately. It is also partly due to the belief that the less understood, the better.”

While it can quickly calculate an overall effective rate, AI can only approximate all the interchange, fees, assessments, processing fees, product fees, and acquirers fees, Hometh said, because those fees are specific to individual providers.

AI Platforms

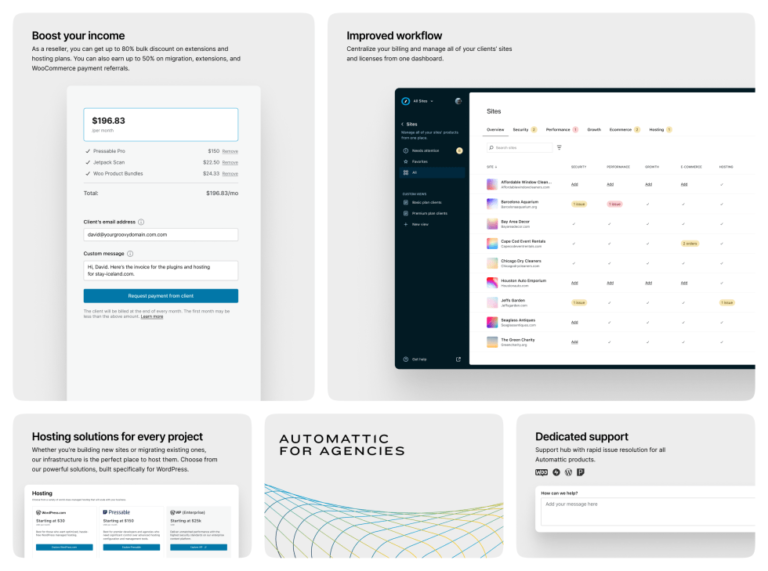

AI tools have emerged to help merchants and payment service providers simplify and expedite statement analysis. Examples are Staitment, established in 2018 by Swipesum, a consultancy, and Fee Navigator, launched the following year. Both are processor-agnostic platforms that the companies claim can analyze statements in seconds.

Michael Seaman, CEO of Swipesum, has seen merchants misinterpret processing fees and assessments. “Many merchants overlook the fact that their processing rates are often about 80% higher than they should be,” he said. “Additional fees, such as PCI compliance fees, gateway fees, and authorization charges, are also frequently missed. Interchange fees are assumed to be billed at cost but are often padded, leading to higher costs.”

Staitment, a processor-agnostic platform, can analyze payment processing statements in seconds.

Adrian Talapan, co-founder and CEO of Fee Navigator, suggested that payment providers could do more to help merchants understand transaction pricing and qualify for the best possible rates.

“One of the biggest mistakes that merchants make is not understanding that their effective rates include card brand interchange and fees, and delivery costs such as processor statement fees, PCI compliance, and others,” he said. “They may be quoted the lowest possible qualified rate, but their true effective rate is inclusive of all costs.”

Expanding Choice

A new fintech, Rift, has brought the marketplace model to payment processing with an open AI-powered platform where merchant service providers compete for customers.

Stephen Martin, co-founder and CEO of Rift, said ecommerce merchants can use Rift’s marketplace to gain transparency into all related cost factors.

“Our platform not only uncovers hidden fees and provides a detailed breakdown of processing costs but also allows merchants to receive competitive bids from top-rated processors,” he said. “This empowers informed decisions, optimizes expenses, and saves money.”

Martin went on to say that ecommerce merchants have unique pricing models and their merchant statements include CVV and AVS checks, which are used to verify customers and mitigate fraud. These additional data points tend to make the reports more complicated.

Rift is an AI-powered marketplace of payment processing providers.

Seaman of Swipesum agreed, stating, “Typically, card-not-present transactions incur higher costs, along with additional gateway fees and technology upcharges. While there are potential discounts and cost savings, ecommerce merchants often face high fees that go unchecked.”

Some ecommerce platforms boost their revenue through these fees, Seaman explained, citing Shopify as an example. Shopify’s Merchant Solutions revenue rose by roughly 20% to $1.4 billion in the first quarter of 2024, largely driven by the growth of Shopify Payments.

Talapan of Fee Navigator noted that small and midsize ecommerce merchants usually pay a flat rate and a per-transaction charge, while larger enterprises negotiate interchange-plus pricing. In all cases, merchants tend to focus on capabilities as much as pricing. For example, a merchant might be willing to pay more for global payment acceptance, recurring or custom pricing schemes, or ease of integration.

Agility, Accuracy

Swipesum’s Seaman pointed out that AI software can evaluate a merchant statement on the spot, while manual audits can take a week or more. Intelligent software can find cost-saving opportunities, he said, and replace labor-intensive processes with immediate, comprehensive analysis.

“A manual audit by an expert usually takes about a week,” he said. “A [software-based] solution provides instant results, identifies opportunities for cost savings, and offers a comprehensive, immediate analysis.”

Talapan mentioned that on-the-spot analyses have changed the game for service providers and merchants. “We saw some sales reps lose money on incorrectly priced deals,” he said. “Others waited days to get an analysis done by their bank or processor.”

Before instant statement analysis, Talapan noted, merchant sales reps had no easy way to reach customers at scale with tailored offers. Now reps can offload number crunching to AI assistants, he said, while they focus on selling.

Hometh of RPY Innovations noted that accuracy is just as important as speed when analyzing merchant statements. “It is not about how fast you can review a merchant statement and provide a lower rate, but rather about delivering an appropriately nuanced comparative view.”

Shop Around

Seaman proposed that auditing merchant statements can reveal key performance indicators, such as average ticket size, cards accepted, transaction types, ancillary fees, and interchange discounts. He advised ecommerce merchants to look for a payment processor with deep experience in the card-not-present market and to monitor fees and pricing constantly. Routinely compare original processing agreements with statements, he added, to expose any pricing changes.

Rift’s Martin encouraged business owners to shop around. “Many ecommerce merchants are unaware of the options available for credit card processing,” he said. “They often assume that they must use the processing services provided by their ecommerce software company. However, there are numerous payment processors to choose from, and exploring these options can significantly enhance their ability to secure competitive rates.”

Hometh characterized AI tools as new and evolving, questioning their ability to interpret subtle nuances in merchant statements. “AI is very good at patterned analysis but not yet ready to call out the patterns that matter,” she said. “Can AI recognize the initial or original agreement to reflect what the merchant should pay?”

She advised merchants to balance AI tools with human oversight, noting that AI’s ability to recognize variations in terminology or fees remains an open question.